The Only Guide to Paul B Insurance Medicare Health Advantage Huntington

Table of ContentsThe Of Paul B Insurance Medicare Health Advantage HuntingtonA Biased View of Paul B Insurance Medicare Part D HuntingtonSome Of Paul B Insurance Medicare Part D HuntingtonThe Main Principles Of Paul B Insurance Medicare Supplement Agent Huntington The Buzz on Paul B Insurance Medicare Insurance Program Huntington

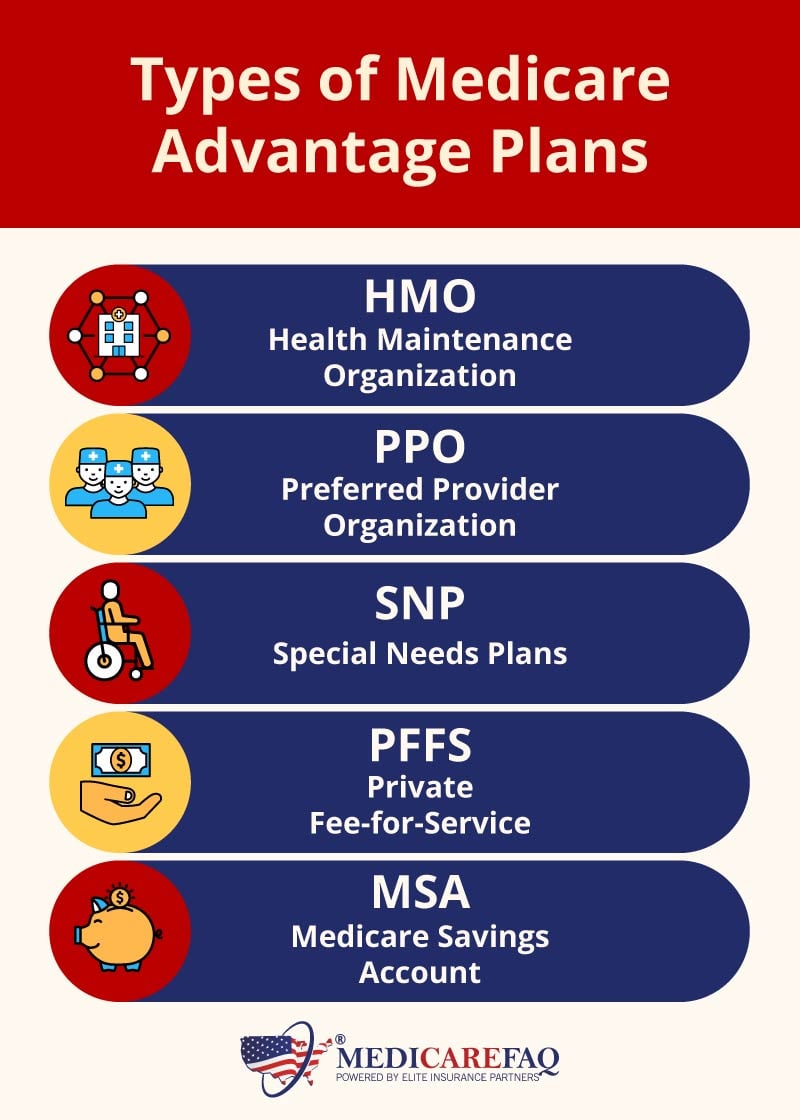

A: Original Medicare, likewise called typical Medicare, includes Component An and Part B. It allows recipients to head to any type of medical professional or hospital that accepts Medicare, throughout the USA. Medicare will certainly pay its share of the cost for every service it covers. You pay the rest, unless you have extra insurance coverage that covers those prices.Attempting to make a decision which kind of Medicare strategy is appropriate for you? We're right here to aid. Find out more regarding the different parts of Medicare and kinds of health care plans offered to you, including HMO, PPO, SNP plans as well as more.

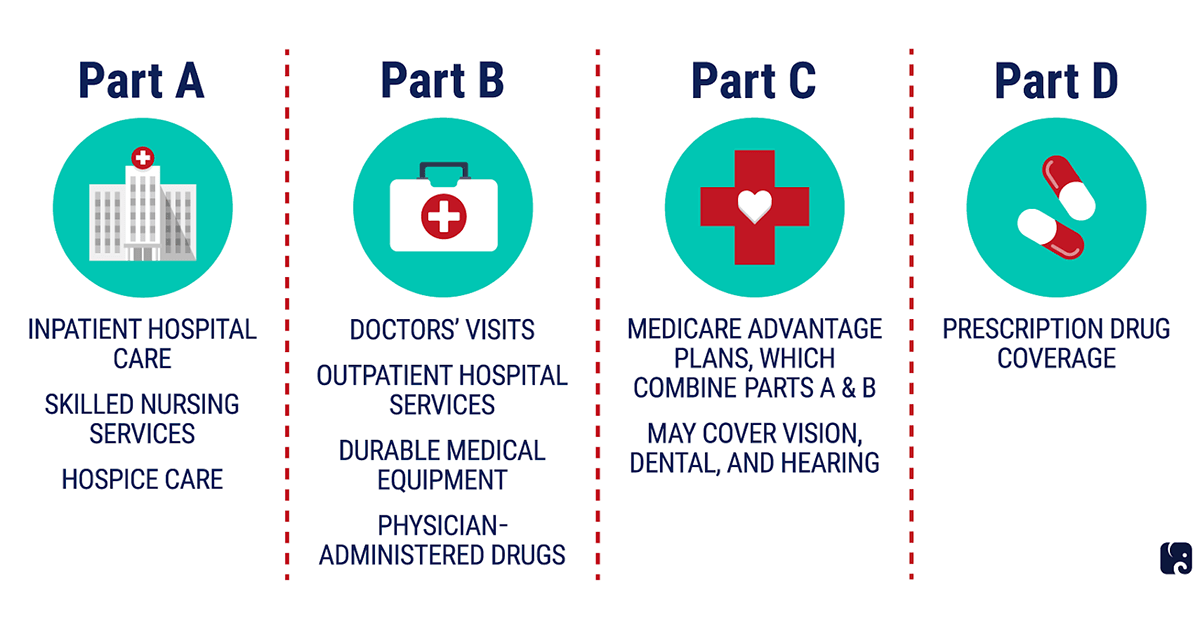

There are 4 parts of Medicare: Part A, Part B, Component C, and Component D. Component A offers inpatient/hospital coverage. Part B provides outpatient/medical insurance coverage. Part C offers an alternative method to receive your Medicare benefits (see listed below for more info). Component D provides prescription medicine protection. Generally, the various components of Medicare assistance cover specific solutions.

It is in some cases called Conventional Medicare or Fee-for-Service (FFS) Medicare. Under Original Medicare, the federal government pays directly for the healthcare services you receive. You can see any doctor and healthcare facility that takes Medicare (as well as the majority of do) anywhere in the country. In Original Medicare: You go directly to the doctor or health center when you need care.

The smart Trick of Paul B Insurance Medicare Health Advantage Huntington That Nobody is Discussing

It is important to recognize your Medicare protection selections and to select your protection meticulously. Just how you choose to obtain your advantages and also that you obtain them from can impact your out-of-pocket prices and where you can obtain your treatment. In Original Medicare, you are covered to go to virtually all doctors as well as medical facilities in the nation.

Nevertheless, Medicare Advantage Program can also provide fringe benefits that Original Medicare does not cover, such as regular vision or oral treatment.

Formularies can vary by strategy, and they may not all cover your necessary medications. Therefore, it is very important to review available coverages when comparing Medicare Component D plans.

Prior to you sign up in a Medicare Advantage prepare it is essential to recognize the following: Do every one of your providers (physicians, medical facilities, etc) accept the plan? You need to have both Medicare Components An and also B and also stay in the solution area for the strategy. You need to remain in the plan until the end of the fiscal year (there are a couple of exceptions to this).

The Basic Principles Of Paul B Insurance Medicare Health Advantage Huntington

Many Medicare medicine plans have a coverage void, likewise called the "donut opening." This indicates that after people with Medicare, called beneficiaries, as well as their plans have spent a particular amount of money for protected drugs, the recipient may have to pay greater costs out-of-pocket for prescription drugs. The coverage space is one phase of the Medicare Component D prescription drug coverage cycle.

Finding out about Medicare can be an overwhelming job. It does not have to be. HAP is here, aiding you understand the essentials of Medicare (Components A, B, C as well as D), the 3 main kinds of Medicare (Original, Medicare Benefit, and Supplemental), and also the enrollment timeline right from signing to changing when a strategy doesn't fulfill your requirements.

Individuals with Medicare have the alternative of getting their Medicare benefits through the typical Medicare program administered by the federal government or with an exclusive Medicare Advantage plan, such as an HMO or PPO. In Medicare Benefit, the federal government agreements with exclusive insurance providers to supply Medicare benefits to enrollees.

The rebate has actually enhanced significantly in the last a number of years, greater than increasing since 2018. Almost All Medicare Advantage enrollees (99%) are in strategies that need previous permission for some services, which is usually not used in traditional Medicare. Medicare Advantage plans additionally have specified networks of carriers, unlike typical Medicare.

A Biased View of Paul B Insurance Medicare Supplement Agent Huntington

Completely, including those who do not pay a costs, the ordinary enrollment-weighted premium in 2023 is $15 monthly, as well as averages $10 monthly for just the Part D part of covered advantages, considerably lower than the ordinary premium of $40 for stand-alone prescription medicine strategy (PDP) costs in 2023.

As plan proposals have actually declined, the discount part of strategy settlements has actually enhanced, and also strategies are designating some of those refund dollars to official site reduce the component D section of the MA-PD costs. This trend contributes to higher schedule of zero-premium strategies, which brings down average premiums. Considering that 2011, federal regulation has called for Medicare Advantage plans to offer an out-of-pocket limitation for solutions covered under Parts An and B.

Whether a plan has only a just cap or a cap for in- and out-of-network services depends on the type of plan.

4 Simple Techniques For Paul B Insurance Medicare Advantage Agent Huntington

As an example, an oral advantage might include precautionary services just, such as cleansings or x-rays, or even more extensive protection, such as crowns or More Info dentures. Plans additionally differ in terms of expense sharing for various solutions and also limitations on the number of solutions covered each year, lots of impose an annual dollar cap on the quantity the plan will pay towards protected service, and some have networks of oral service providers recipients should choose from.